- Home

- News

- What’s On

- Activities for Children

- Arts & Crafts

- Autos and Bikes

- Business events

- Car Boot & Auctions

- Charity events

- Churches & Religious

- Comedy

- Dance

- Days out & Local interest

- Education

- Exhibition

- Film

- Gardening & Horticulture

- Health

- Markets & Fairs

- Music

- Nature & Environment

- Spiritual

- Sport

- Talks and Discussions

- Theatre and Drama

- Business

- Local Information

- Jobs

- Deaths

- Charity events

- Contact Us

Watch out for scam text messages

With the coronavirus pandemic to deal with many people will have enough on their plate, but having just received what’s evidently a scam text message – I have to assume that many more will be out there.

If you have any friends or relatives who may be vulnerable to such a scam let them know.

The text message states:

“Lloyds would like to verify a debit card payment of 3762.00Gbp ,

Please reply Y for Yes or contact us on 03333355196″

I immediately picked up the tell-tale signs of poor grammar and punctuation but if you have other issues to deal with it’s easy to be taken in and just hit the hotline which will take you somewhere you don’t want to go.

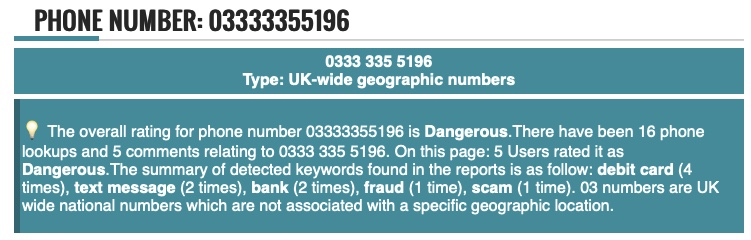

I’ve checked the phone number with one of the web number-checking sites with the following result:

According to recent reports the most widespread texts appear to come from a scammer pretending to be Lloyds Bank. Others have purported to be from HMRC.

Like many so-called “phishing” attacks, both these scam texts attempt to lure the victim into clicking on a link – either to change details or confirm identity or perform some other action.

Many people have realised the text is a fake and reported it to Lloyds as well as publishing it on Twitter to make others aware.

Even though text messages like this may look genuine, they’re not. Banks and government agencies will never get in touch with customers and ask them for details with a text message. If you’re ever in any doubt, it’s always best to check with your bank – something that can sometimes be done quickly over social media.

Financial Fraud Action UK (FFA UK), which fights fraud in the payments industry, says people should remember that their bank will never phone them to ask for their four-digit card PIN or their online banking password, even by tapping them into the telephone keypad.

Banks will not ask people to update their personal details by following a link in a text message or ask them to transfer money to a new account for fraud reasons, even if they say it is in the consumer’s name.

Katy Worobec, director of FFA UK, said: “These text messages can look very authentic, so it’s important to be alert. Always be wary if you receive a message out of the blue asking you for any personal or financial details.

“If you’re ever at all suspicious, call your bank on a number that you know. Remember, fraudsters are after your security details – don’t reveal anything unless you are absolutely sure who you are dealing with.”

In fact, Lloyds Bank has set up a dedicated website to deal with the issue, which can be found here.

You must be logged in to post a comment Login